CreditSnap is a pre-qualification digital lending solution that includes soft-inquiry technology. Lenders using pre-qualification capabilities consistently see up to 30% lift in funded loans.

Bring in 10%-20% more top-of-funnel borrower applications.

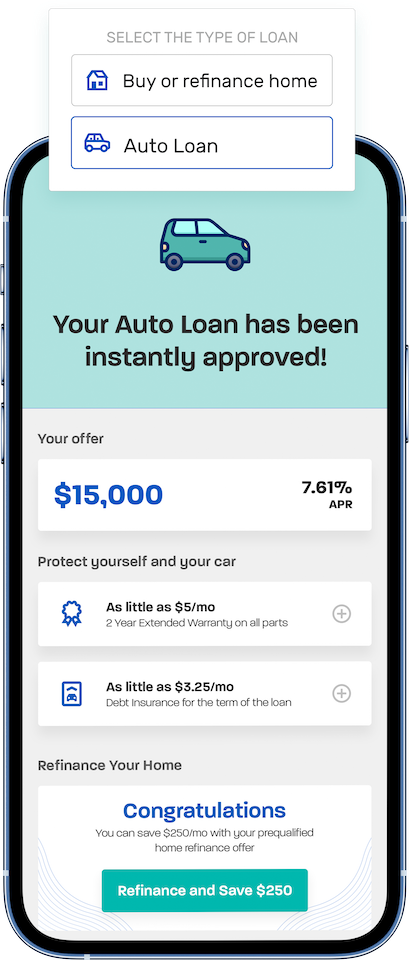

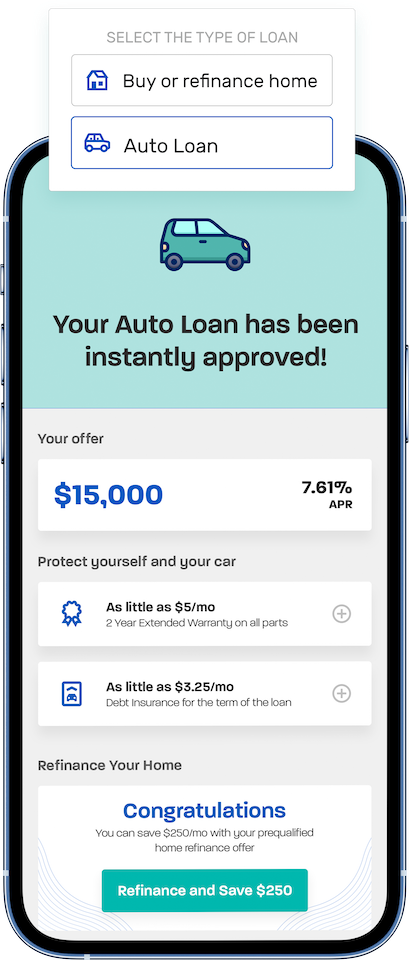

A streamlined application uses a soft credit pull to deliver qualified offers to the borrower and reduce application abandonment and loan offer rejection rates.

Enhanced member engagement and increased conversion result in greater loan volume overall.

Accepting applications over the phone and at the branch is a breeze thanks to an end-to-end, omnichannel platform and robust back-office portal.

With the power of AI and expansive decisioning capabilities, the cross-sell engine evaluates the borrower’s credit scenario to determine which offerings are applicable, for how much, and where the odds of conversion are highest.

Integrate lending applications with your LOS solution or directly into your core.

Options include digital account opening, digital ID verification, and integrated account funding.