As more credit unions connect to immediate payment rails and begin sending transactions, it’s time to look ahead to the next frontier in payment service: Request for Payment (RfP).

RfP empowers credit unions to modernize their payment offerings in alignment with their member-first mission by unlocking new ways of doing business, meeting evolving member expectations, enhancing operational efficiency, and sustaining a competitive edge. As digital expectations rise, members are no longer satisfied with slow, fragmented payment experiences. They want clarity, control, and immediacy—qualities that RfP delivers by design.

What is an RfP?

An RfP is a financial messaging service that enables a payee (such as a business or individual) to send a digital request to a payer, prompting them to authorize and complete a payment. This request typically includes pertinent details, such as the amount due, due date, and invoice information. RfP is a service available on both the RTP® network and FedNow® Service that allows customers of participating financial institutions to request funds in real-time.

Why RfP Matters

RfP offers several benefits that align with credit union goals:

• Reduced Payment Failures: RfP includes all necessary transaction details and requires user authorization, thereby minimizing errors and reducing operational costs associated with failed payments.

• User Control: Using a push payment model, RfP ensures users approve each transaction, adding a layer of security and preventing unauthorized debits.

• Improved Cash Flow: Real-time processing and 24/7 availability enable businesses to receive funds instantly, boosting cash flow predictability—even on weekends.

• Enhanced Member Experience: Members see precisely what they’re paying for before authorizing, while businesses benefit from final, irreversible payments, eliminating chargebacks and returns.

Common RfP Use Cases

RfP offers compelling use cases for various financial services:

• Member Loan Payments: Credit unions can modernize loan repayment by using RfP to prompt members for real-time payments directly from their accounts. This replaces manual transfers and scheduled ACH with instant, member-authorized payments—reducing missed payments, avoiding late fees, and improving convenience. It’s also a strategic entry point for credit unions to begin using both Send and RfP profiles, starting internally and expanding outward to members.

• Bill Payments: Utility companies, telecom providers, and other service organizations can send RfPs to customers, enabling them to review and authorize payments instantly.

• E-Commerce Transactions: Online retailers can use RfP to request payment at checkout, offering a secure, real-time alternative to card-based or delayed payment methods.

• Gig Economy Payments: Freelancers and gig workers can send RfPs to clients upon task completion, streamlining the invoicing process and ensuring timely compensation. This replaces emailed invoices and delayed bank transfers with instant, verified payments.

• Insurance Claims and Refunds: Insurance companies can use RfP to collect premium payments or initiate real-time disbursements for claims and refunds. This replaces mailed checks and batch ACH with faster, more transparent transactions that improve policyholder trust and satisfaction.

Other use cases include:

• B2B (Business to Business)

• A2A (for bank & broker accounts)

• Recurring consumer bill pay, including installment loans

• Consumer down payment, security deposit, final payment

• Installment loans

• A2A (Me2Me) for restricted use non-bank wallets, and where funds cannot be converted to cash or virtual currency, is used to pay for other services, etc.

• Government payments

• Healthcare payments (e.g., for patients paying a medical bill)

• Use cases between trusted parties (employer/employee)

How the RfP Process Works

To begin with, it’s essential to understand the two personas involved in the RfP.

1. Payee (Requester):

• Who They Are: Businesses, service providers, or individuals expecting payment for goods or services rendered.

• Objectives: To receive payments promptly and efficiently, improve cash flow, and reduce the administrative burden associated with payment collection.

• Actions: Initiate a Request for Payment to the payer, including all necessary transaction details.

2. Payer (Responder):

• Who They Are: Customers, clients, or individuals who owe payment for received goods or services.

• Objectives: To manage and control their outgoing payments, ensure timely settlement of obligations, and maintain accurate financial records.

• Actions: Receive the Request for Payment, review the details, and authorize the payment, often through a convenient digital platform.

Step 1: Initiation

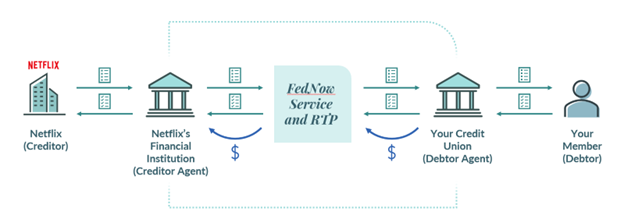

Netflix initiates a Request for Payment for Joe’s monthly subscription fee through its financial institution (Creditor Agent) using its internal billing system (outside of the FedNow Service or RTP network).

• Details included: Amount due ($15.99), due date, invoice ID, and service description.

Step 2: Message Sent

Netflix’s financial institution sends an RfP message to Joe’s credit union (Debtor Agent) via the FedNow Service or RTP network.

Step 3: Initial Response (Optional but Recommended)

Joe’s credit union receives the RfP and sends a message back to Netflix’s bank. This response might indicate:

• RCVD (Received): The message was received successfully.

• PRES (Presented): The RfP has been presented to Joe.

• Or, if there’s an issue, the RfP may be rejected at this stage.

Step 4: Presentation to Joe

Joe receives a notification from his credit union’s mobile app or online banking portal. It shows:

• “Netflix has requested a payment of $15.99 for your monthly subscription. Do you approve?”

Step 5: Joe Responds

Joe taps “Approve” in his credit union app, authorizing the payment.

Step 6: Final Response

Joe’s credit union sends a final message to Netflix’s financial institution via FedNow or RTP, confirming that the payment request was Accepted.

Here’s the key distinction in this use case:

• Joe’s credit union, acting as the Debtor Agent, sends a final message to Netflix’s financial institution confirming Accepted.

• The credit union also initiates the payment on Joe’s behalf via the FedNow Service or RTP network — effectively serving as the sender of the payment.

Step 7: Confirmation

Netflix’s financial institution notifies Netflix that Joe has approved the payment. The funds are transferred in real time, and Joe’s subscription is renewed instantly.

By integrating RfP, your credit union doesn’t just keep pace—it sets the pace. It’s a smart move that enhances your digital offerings, strengthens your brand, and ensures you remain a leader in the financial lives of your members. As payments continue to advance, RfP positions your credit union at the forefront of innovation—delivering speed, transparency, and trust in every transaction.