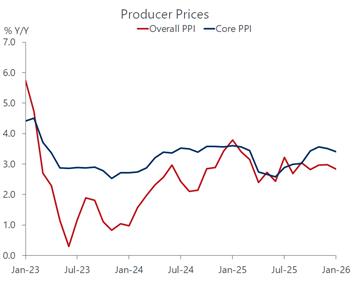

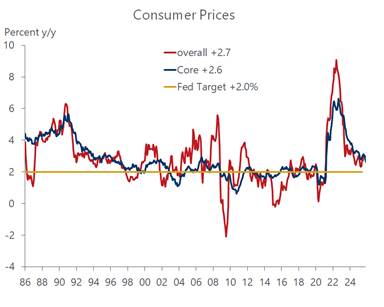

The Federal Reserve could not be happy with the hotter than expected print for wholesale prices released on Friday. The PPI increased by an outsized 0.5 % in January following an upwardly revised 0.4 % advance in December. While the core PPI came in as expected, at 0.3 %, the service price components remained sticky and will contribute to an elevated reading in the Fed’s preferred inflation gauge, the Personal Consumption Deflator, when it is released next month. The reading reinforces the consensus view that policy makers see no urgency to cut rates at its upcoming March meeting. Importantly, the news contributed to the unsettling backdrop for stocks, which fell again on Friday and ended February with the first monthly loss for the S&P 500 since last April.

To be sure, the less friendly inflation backdrop is not the only – or even the primary – reason investor jitters are rising. Amid the heightened tariff uncertainty imparted by last week’s Supreme Court ruling, markets are bracing for an imminent military conflict with Iran that raises a spate of possible negative consequences, including a spike in oil prices. Crude gained over 2 percent on Friday morning and was on track to close at the highest level since last July. But despite the heightened inflation risk from the week’s developments, traders sent interest rates lower, with the 10-year Treasury yield falling below the 4 percent threshold for the first time this year. The divergent moves between stock and bond prices reflect the time-honored flight to safety when fears of the unknown abruptly escalate and prod investors to seek the safest asset to park their funds. That’s still the Treasury market, notwithstanding its own battles with spiraling deficits and souring relations with major foreign holders of U.S. government securities.

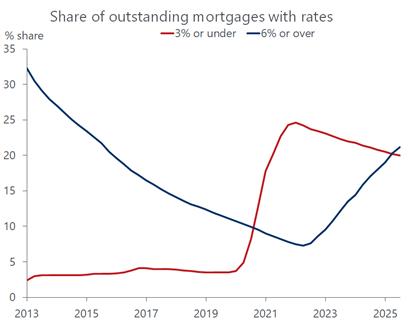

The slippage of bond yields cast a brighter spotlight on mortgage rates, which are closely linked to the 10-year Treasury yield. Like the latter, mortgage rates also fell through a psychological threshold this week, dipping below 6 percent for the first time in more than three years. That event ignited a swirl of headlines suggesting the wondrous things about to befall the housing market. The burst of optimism received heft from the observation that there are more mortgages outstanding with a 6 percent rate than with a 3 percent rate, indicating that the pool of homeowners poised to refinance their mortgages has expanded. It also suggests that those who were previously locked into their homes are now ready to sell, as the cost of giving up their low-rate mortgages has diminished. We caution, however, to hold the champagne, as the crossing 6 and 3 percent lines is not as exceptional as it seems.

True, there are now more homeowners with 6 percent than a 3 percent mortgage, but that’s not a particularly unique event. Prior to 2020 that was usually the case, according to data compiled by the Federal National Mortgage Data Base going back to 2013. It was only when the pandemic struck, and interest rates plunged amid the recession and its aftermath that homeowners raced to refinance their mortgages at rates that fell to as low as 2.77 percent from over 7 percent. That removed a big chunk of higher yielding mortgages from the equation. But as interest rates began to climb in late 2021, reaching a high of 7.22 percent in 2024, so too did the share of higher-yielding mortgages on the books. Still, the average rate on all outstanding balances is considerably lower than the current rate, standing at 4.14 percent in last year’s third quarter according to FNMB. Hence, there is still a ways to go before that threshold is reached, much less to the level that would make it worthwhile for homeowners to incur the cost of refinancing.

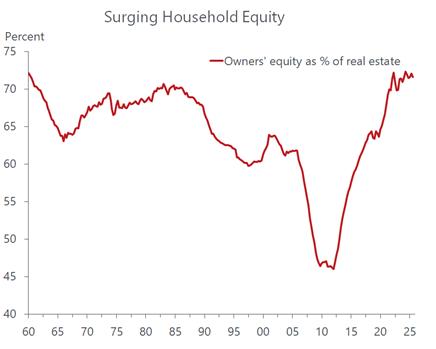

Keep in mind too that the share of households that own their homes outright, without a mortgage balance, has increased. It rose to about 40 percent according to the 2024-2025 Census figures, up from 33.4 percent in the 2010-2014 period. For this cohort, the good news is that every dollar increase in home prices feeds into their housing equity, enabling a faster buildup of wealth for homeowners entering retirement age and beyond. That should accelerate a trend that has been underway for some time and sustain the wealth effect on consumption. The home, of course, is not a liquid asset, but it can be used as collateral for borrowing and encourages homeowners to save less and spend more. The bad news is that it nurtures the bifurcation of the consumer sector, widening the purchasing power divide between those who own homes and financial assets and those who do not.

That makes the upcoming jobs reports loom larger in importance for the Fed, which is keenly aware that people with little or no assets (real or financial) rely entirely on incomes to support spending. Most of their income, in turn, derives from wages and salaries, with an assist from government transfers. Rising concerns over a softening job market encouraged the Fed to cut rates three times since September. But those fears abated with more recent evidence that labor conditions are holding firm, highlighted by the blockbuster surge in payrolls in January. Following that report and few signs that inflation is receding, the Fed moved to the sidelines in January and is expected to stay there at the upcoming March 17-18 meeting.

That confab will also present the quarterly projections by Fed officials of where they see growth, inflation and unemployment heading for the rest of the year, as well as their longer-term outlook. There will be two more jobs reports prior to that meeting, including the February reading scheduled for next Friday. All eyes will be on whether the January payroll surge was sustained or erased by revisions and/or a major setback in February. There continues to be high-profile layoff announcements, but so far they have not translated into a higher unemployment rate. The weekly data on first-time claims for jobless benefits remain low, indicating that the unemployment rate will remain so as well for February. But an unexpected spike will no doubt raise the odds of a rate cut sooner rather than later.

Importantly, the report will give us another glimpse as to how worker earnings are holding up, a critical influence that will drive spending of the less wealthy household segment. The good news is that worker earnings are still outpacing inflation by about 1 percent. That bad news is that earnings growth is slowing, even as inflation remains sticky, narrowing that gap. With low-income households about to receive an infusion of refunds from last year’s tax legislation, a buffer to support spending through at least the spring will be hitting bank accounts. That impact will fade thereafter, but we expect that inflation will also recede over the second half of the year, allowing the Fed to soften the blow from lost purchasing power by resuming its rate- cutting campaign.