Volatility is the word that best describes the first six months of 2022, especially the month of June. In fact, if we were to use pop-culture meme language to describe the markets during the past few months, it might go something like this:

January – May: “Nothing in the economy could be as volatile as the past five months.”

June: “Hold my beer.”

Following May’s Federal Open Market Committee (FOMC) meeting, the assumption for much of the time was that the FOMC would likely raise the overnight rate 50 basis points in June, mirroring May’s increase. This assumption was altered beginning June 10 when two reports were released that basically spooked the markets. The first was May’s Consumer Price Index (CPI) report that revealed higher-than-expected headlines and core inflation numbers. The CPI showed that prices rose 8.6% year over year and 1% month over month while core CPI was up 6% year over year and 0.6% month over month. That same day, the University of Michigan (or “That School up North” for Buckeyes’ fans) Consumer Confidence number was also released. The survey set a record low.

At this point, the U.S. treasury market had begun to sell off. Speculation began floating around that not only does the FOMC need to act more aggressively, but also that they would in fact act more aggressively at the upcoming meeting. The U.S. treasury market began selling off trading with higher yields and lower prices. At one point, the 2-year yield moved close to 3.45%, up nearly 100 basis points from the beginning of June. Then, the FOMC met in mid-June and raised the target rate to 75 basis points.

After the meeting, markets began to stabilize as rates adjusted to even higher projected rates. Market volatility is likely to remain until inflation and other factors, such as a resolution to the war in Ukraine, begin to subside or show evidence of inflation subsiding in the future; this includes evidence that the policy tools the FOMC has implemented (open market operations and balance-sheet reduction) are working. Monetary policy tightening rarely comes with orderly markets, and the FOMC has vowed to press on until inflation meets their target.

Second Quarter Economic Update webinar: Now available to watch on demand

Hosted by Chief Investment Officer Bob Post with special guest Perry Jones

Reviewing the dot plot forecast

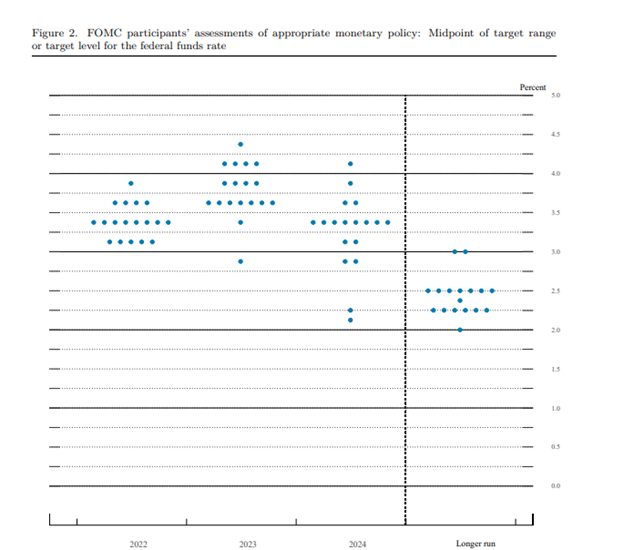

Below is the FOMC’s dot plot. As a reminder, the dot plot is simply a chart that summarizes the FOMC’s outlook on interest rates. Up to 19 Fed officials can contribute their perspectives, and they do so anonymously. The dot plot is released every three months, and June’s dot plot is below.

The dot plot now projects the overnight rate at 3.40% for the end of 2022 and 3.80% for 2023. This differs from the March plot. You can find this and other info from the June FOMC meeting here.

Inflation and the consumer

The consumer is certainly feeling the effects of inflation. The record low Consumer Confidence number mentioned above in comparison with other economically challenging times (housing/financial crisis in 2008, the tragedy of September 11, 2001, etc.) is likely a harbinger of inflation and negatively impacts the consumer’s perception of their own economic wellbeing. While economists might look more toward core inflation data, the consumer includes food and energy, especially while staring at the big number on the gas pump.

While there may have been a peak or a “relief” in the price of goods as evidenced by high inventories at retailers, consumer behavior has shifted more towards services like travel, so higher prices are shifting to services. The FOMC has the policy tools to try and slow down economic activity, but these tools only go so far; they can’t solve the supply chain issues or end the conflict in Ukraine favorably by raising the target rate or not reinvesting principal from a mortgage-backed security.

Even with a still-favorable environment for employment, it is difficult for the consumer to be confident when more of their paycheck is going out the door for basic needs and there is less money sitting in their retirement account.

What we are seeing at credit unions

Corporate One’s VP, Portfolio Manager Perry Jones joined our CIO Bob Post on this month’s economic webinar and shared some worthwhile information regarding the liquidity situation at credit unions. Corporate One has seen some cash runoff after being flush with liquidity the last couple of years. We’ve also been having more and more conversations with credit unions about lines of credit or other funding sources (issuing CDs). In addition, we have seen through the SimpliCD program an increase in new credit union issuers or dormant issuers coming back into the market. Year-to-date data (as of the end of April) showed lending was up 5.6% and that surplus funds (cash and investments) have decreased $7.5 billion.

The overall tightening of liquidity is a combination of lending growth, the consumer spending more, and, unfortunately, the higher costs of everything from groceries to utility bills. Some insights and practical takeaways and recommendations for what credit unions could or should be doing right now are listed below. (And really, these are good tips regardless of the economic environment.)

- While everyone continues to try and keep/grow core deposits and might typically post loan rates based on this, it might be a better practice to base loan rates on external funding rates.

- Market volatility (talked about earlier and during the webinar) has warranted having more frequent meetings or conversations in setting rates.

- Evaluate and test all funding sources. Your credit union may ask:

- Do we have enough liquidity?

- What is the process? How do I go about getting a loan or drawdown?

- Who is authorized at the credit union to request a loan or drawdown?

- Do we have adequate wire limits in place if we need to send funds from that provider to another entity?

Final thoughts

It’s clear that inflation has persisted far longer than many officials thought it would. The FOMC continues to vow to fight inflation. Markets are likely to continue being volatile until there is concrete evidence of inflation beginning to turn around and that monetary policy is working and not overworking (slowing the economy down too much). The FOMC has a tall order and needs to try and thread the needle to tame inflation and prevent recession. There certainly is a feeling that perhaps the FOMC is behind the curve a bit (although I can certainly play “Monday morning quarterback” with the best of them). As always, our investment and funding team is here to assist your credit union with all your investment and liquidity needs. Feel free to reach out to us any time and we are happy to consult with you.

Jeff Duesler

Senior Investment Services Representative