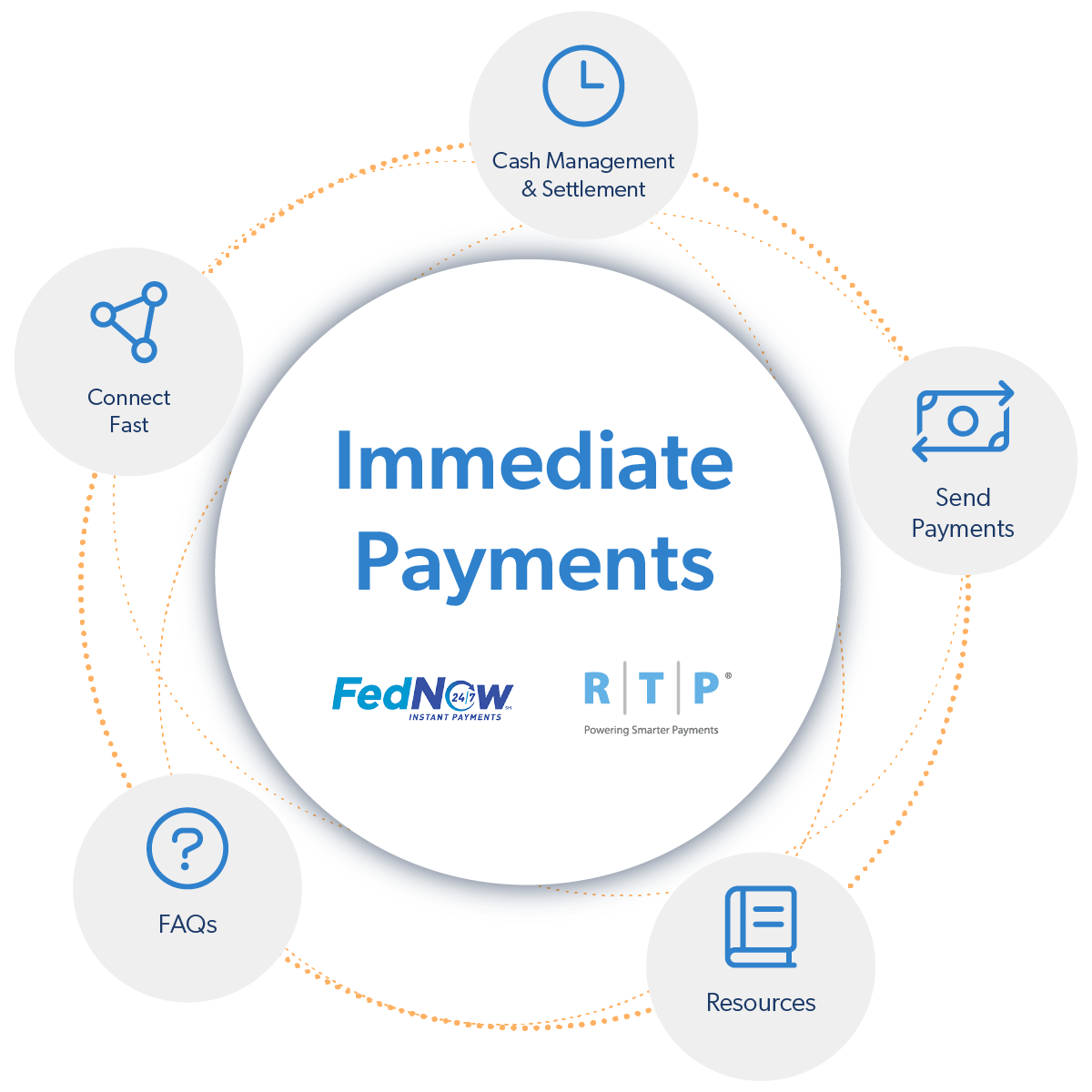

Immediate payment solutions in seconds

Corporate One has the knowledge, expertise and technical capabilities to support credit unions transitioning from faster to immediate payments. Our solutions are made for credit unions by credit unions to help your credit union seize the power of immediate payments.