Like so many times in the past, the Federal Open Market Committee’s (FOMC) decision to raise rates again this month surprised very few people; it was the language following their meeting that grabbed everyone’s attention. The FOMC raised the target fed funds rate ¾ of a percentage point (75 basis points) as expected, moving the high end of the target rate range to 3.25%. This action disappointed those who believed the FOMC would raise the rate by 1% (100 basis points), an outcome that was given only a 20% chance of happening prior to the meeting.

Corporate One’s Chief Investment Officer Bob Post provided some valuable information during his latest economic webinar regarding the rate decision and the future path of interest rates. You can access the on-demand version of the webinar here along with his slide presentation, which many credit union investors have found useful in the past.

Weekly Market Commentary

For further economic insight, check out our complimentary, weekly market commentary. It’s accessible on Corporate One’s homepage under “Keep up to date with our latest news and resources", or under the Resources page.

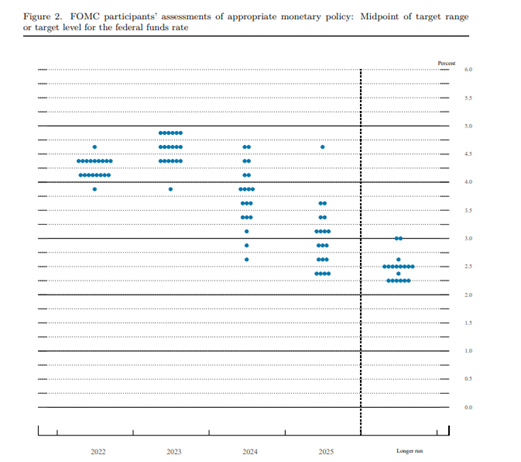

Reviewing the dot plot forecast

The dot plot now projects the overnight rate at 4.40% for the end of 2022 and 4.60% for 2023. If you are keeping score, at the end of the June meeting the projection for the end of 2022 was 3.40%, which is lower by 100 basis points. A graphic of the dot plot is below; it can also be accessed in the Federal Reserve’s summary of economic projections.

Liquidity at credit unions

Higher prices and higher interest rates, coupled with a higher demand for loans, has caused an increase in demand for external funding sources. The average loan-to-share ratio at credit unions is up 6% year over year to over 76%. Total surplus funds in the system are down from $732 billion to $643 billion. Internally, we continue to see an increase in loans to our members, as well as an increase in demand for non-member deposits. (To learn more about Corporate One’s non-member deposit programs, visit this page.) We usually experience a trough (or low point) in late September/early October and then begin to see our cash balances increase going into year end. This year, it will be interesting to see if this trend continues.

In addition, while the demand for consumer credit has increased, I’m inclined to believe that with continued equity and bond market volatility along with the ease of transferring funds between financial entities, higher interest rates might cause investors (especially those in retirement looking to preserve principal) to throw up their hands and seek the safety of savings accounts. Doing so could cause an injection of liquidity into the system. Member-centric rather than earnings-centric large banks focused on share prices should be able to offer superior rates and capture these deposits, and, in most cases, will welcome the liquidity.

Summary

Fighting inflation continues to be the FOMC’s top priority; the precipitous rise in interest rates hasn’t cooled off a strong labor market, which continues to give the FOMC the green light to be more aggressive with rate hikes. The FOMC will keep monitoring the data as it will continue to be a balancing act between cooling things down and an outright freeze. Expect the upcoming election season, the current global turmoil, and the economic data to all chime in on the outcome of monetary policy decisions as we move forward.

As always, if your credit union would like to take advantage of these higher rates or discuss liquidity options, your senior investment representative and our lending department stand ready to guide you. Reach out to us at 800/366-2677 or [email protected].

Jeff Duesler

Senior Investment Services Representative